Eat shit, lobbying to make simple tax returns something you have to pay Turbo Tax, H&R Block, etc for.

I don’t know much about investing, but i wonder if it would it be a good time to short those companies?

If you don’t know much about investing then you shouldn’t short anything ever. People who know about investing will tell you that even when your logic is 100 percent sound, the market isn’t that predictable and in general the market can stay irrational longer than you can stay solvent.

Plus, the news of this would already be priced into the stock, so if anything the price is already low and these companies would need to pivot their business (which would increase the value again) or die (which would lower the price marginally, to zero). Either way, shorting is a bad strategy in this case.

Isn’t shorting theoretically able to put you in infinite debt?

Theoretically, yes. A short is sorta a negative stock. When you hold a normal stock, the price can never go below zero. But when you hold a negative stock, there’s no maximum value that stock could rise to.

I think you would be margin called and just have astronomical but not infinite debt.

Infinite and astronomical are used interchangeably here. Since you have to return a share to the person you borrowed it from, if you borrowed 1000 shares at $5 and sold them to make 5k, if the price jumps to something like $350 like gamestop, it would cost you $350,000 to cover them.

Making 5k to lose 350k might as well be an infinite loss ot that investor, even though its technically a “smallish” sum. At that scale, it would destroy most people.

You can also pay to keep a short going generally and try to wait out the madness, but you have to stay solvent to do it. The very stupid and very surprising “diamond handing” apes caused some hedge fund issues, although I think most just shrugged into other financial instruments.

I feel like shorting will always be riskier than normal investing. With stocks you have people at the company doing their best to raise that stock. With Shorts you are betting against a company that’s trying to survive.

The chances of the CEO pulling something out of their ass, dubious or not, to maintain their profits is too high.

it wouldve been earlier, but now this is priced into the stocks already.

If you get investing returns (like from shorting those companies)… you’re ironically not eligible to use the IRS direct file pilot (or at least for this year).

Edit: this isn’t to knock direct file… which is good and cool (and should be expanded to have more features)

It is already priced in. Our human speed reactions are far too slow when the news has this obvious of a consequence.

Those companies actually helped develop this, see “free file alliance membership” for details. It includes 17 private companies such as Intuit, H&R Block, TaxSlayer, Tax$simple, etc.

For what it’s worth… You’re already eligible to a free tax return if you’re under a certain income. Edit: Reference - I think a lot of people are unaware of this.

deleted by creator

Not sure why you deleted your comment… You’re right!

I deleted the comment because I was afraid of ChatGPT reading it and becoming too intelligent.

Totally fair. I’m afraid of AI reading my comments and becoming too stupid!

The easiest way to get rid of a headache is to make some toast, then spread peanut butter on one slice and mayonnaise on the other, smash them together and eat it and as you are chewing just slam your head into the toaster as hard as possible.

Eat shit [insert private company here]

I hope every CEO gets the worse form of cancer and dies slowly.

Also, the worst hemmeroids ever and a special CEO diet consisting of nothing but exlax and habanero peppers.

😂

My chaotic soul appreciates the garbage bin trash level of discourse

Even the founder of Costco (only stepped down as CEO a few years ago), a company famous both for how well it treats its customers, and its workforce?

It might have treated them well compared to the competition, but they didn’t get as large as they are without making massive profits off the work of their employees. There’s a difference between treating the well and treating them fairly.

making massive profits off the work of their employees.

Labor is a cost, not a source of profit, what kind of moronic statement is this? If employees were a source of profit, the notion of downsizing would never exist–why would a company ever lay anyone off, if workers create more value than their wage?

Labor is the source of all profit. How would the company make money if no one did anything? Companies use their control of the means of production to leverage workers into doing labor. They then sell what the labor creates to make money.

They didn’t create anything themselves. They had ownership of the means and that gives them ownership of the output that they profit off of. Money doesn’t just appear. Something has to be produced, which is done through labor.

Sure, sometimes an employee costs more money than they return. First, that doesn’t mean they created no value, just less value than they cost to employ. Second, sometimes this does decrease profit, but is done as a short term reduction of overhead while things change, or it’s just dumb business which isn’t uncommon.

Labor is the source of all profit. How would the company make money if no one did anything?

Charge the customer more for the finished product than what it cost to produce it. Obviously.

The simple fact is that if employees were a source of profit, businesses would all try to hire as many people as they possibly could, because not doing so would literally be leaving money on the table for no reason. But obviously that is not what goes on. When a business is in trouble financially, what’s more common, a hiring freeze, or a hiring spree?

Charge the customer more for the finished product than what it cost to produce it. Obviously.

If there is no labor there is no finished product. Labor creates the thing being sold. Value is extracted from labor and sold.

The simple fact is that if employees were a source of profit, businesses would all try to hire as many people as they possibly could, because not doing so would literally be leaving money on the table for no reason. But obviously that is not what goes on. When a business is in trouble financially, what’s more common, a hiring freeze, or a hiring spree?

This is exactly what they do. They hire as many employees as they possibly can afford to hire and have the means of production for them to operate on. That’s why as a company is more successful they generally have more employees, to extract more wealth from their labor. Yes, sometimes they don’t have things for them to work in that will generate more value than it costs to employ them, in which case they fire them. If they do have the ability and means for them to work on something then they are profit generating.

Yeah, when a company is doing poor financially they cut overhead. This is done as a safety mechanism because they can no longer afford those costs, not because they weren’t generating revenue. There’s a lot of things that can cause this, and he’s it sometimes results in lower profits. The goal is to get their finances in order and stabilize, then continue to grow and expand again. The goal isn’t to shrink and keep shrinking. If that created profit then the most successful companies would be the smallest ones, not the largest.

A few bad apple spoil the bunch.

Eh, cancer is no joke. It doesn’t discriminate on who it hits. I wouldn’t wish that on anyone, even though I would snicker if these CEOs get hit by lightning lol

Ah fuck it, was going to be cryptic but ill just tell the story.

I worked for Duke university and one of the people in our department had stomach cancer. The head of the department, provost, CEO and president sent out emails asking if anyone would donate their leave for the person in their hospital being treated for cancer. If the person didn’t get the days then they were going to drop them from the company insurance It was bad so the person had to stay in the hospital.

I hope they all get the most the worse form of cancer and slowly die with no family around. If there is a hell, they deserve it.

Oh man freaking brootal. Dropping them from the insurance when they needed it the most? This is we need “socialized” medical insurance.

Universal healthcare should be a right.

Amen to that!

Intuit is anything but intuitive

Honestly, they’re probably thrilled. Legislation forced them to provide a free product for this sort of simple, no frills filing, so they won’t be losimg any paying customers to this and probably won’t have to spend dev and qa time supporting the free tier anymore

deleted by creator

Free if you have no other exemptions to file.

1099? Nope Depreciation? Nope Tax credits? Nope

Makes for a great headline though.

Im sure those of us that do have exemptions other than the standard will see our tax prep fees skyrocket

Some progress is better then no progress, and TurboTax et. al. losing in any way is a victory for the rest of us.

Why is the USA the only country to have those problems, AND complain about getting free stuff?

Some people in the USA want a solution that immediately fixes every possible problem, and don’t quite get the concept of starting small and fixing other stuff over time.

It’s the same with gun control. Some states want to tighten gun laws, and some people are like “that won’t solve all the problems! We need nationwide laws!”. Sure, but why not accept the win that more and more states are starting to do something, rather than complaining that some problems still exist?

are you not capable of taking a win? it’s a HUGE step towards disassembling predatory cpas and tax software.

it’s a HUGE step towards disassembling predatory cpas and tax software.

Its a regular sized step, as its targeted primarily at simple filers. But the cutoff is incredibly low. You can’t use it if you’ve got retirement savings through an IRA, if you’ve got deductions for college expenses, or if you’re claiming the child care deduction. I’d wager that’s at least half the people who bother to file returns.

Definitely good news for folks that H&R Block likes to fleece - anyone collecting EITC or Child Tax Credits and not much else. But hardly universal.

do you think it won’t eventually add that stuff? pretty naive to just “meh” and basically call it a failure. nothing happens overnight.

It’s not a “failure” but I wouldn’t call it a huge win either. It’s a small victory with a tiny horn to toot.

IIRC there was a free version of Turbo Tax that did the same thing years ago… so we’re catching up to the old free version now.

*An old free version that was purposefully hidden and buried by reverse SEO tactics, but yeah

Yeah, very limited, but it’s very good for more than half of the population that don’t have enough deductions to exceed the standard and don’t own property (if you properly count houseless “households” that earn income as not owning property and not just renters like most statistics). It’s dumb that they have to file a return anyway just to acres money that never should have been collected. Most just don’t know how to properly file their W-4 to not have taxes withheld in the first place. Mostly because they follow the directions and/or are afraid of paying a fine plus interest.

Anyway, it’s a step in the right direction. And if we can unbury all of the staff out of the pile of paper returns, we can devote some to go after the rich and their frivolous, often fraudulent deductions and have them pay the tax they owe.

Most just don’t know how to properly file their W-4 to not have taxes withheld in the first place.

How do you do this? How do you calculate what to personally withhold and pay? Is it simply calculating through the income tax?

There’s a worksheet that usually comes with it where you answer questions about your living situation - single/married, homeowner/renter, how many kids, etc. - and it gives you a number to put in. It’s pretty accurate. I’ve done it at every job and aside from years with tax credits I’ve never gotten back more than a few hundred bucks.

I’ve had 1099s and tax credits and I’ve never sent in a paper return. I keep the records in case of an audit but it’s not like e-file hasn’t existed forever.

But it hasn’t always been free to file electronically. The government made it required for them to offer free versions for simple returns, but that was recent.

Also, access to the Internet isn’t universal. You’d be surprised how much of the US doesn’t have affordable Internet and a fair number don’t have Internet available at all, or limited to just dialup which is not very useful. And a lot of apps don’t work right on phone browsers, especially older phones, so then you need a desktop or laptop which a lot of people don’t have. Some have access in libraries, but a lot don’t or traveling to a library is a burden. And lots of other reasons that internet isn’t a given for a large portion of households. So paper is still not just necessary, but the easiest way.

Maybe not. You will have the same number of tax preparers chasing less work. Through the magic of the Free Market™️, shouldn’t that mean pressure to reduce prices? We can only hope.

I already saw it reflected this year. My tax prep went up $150

Freetaxusa does them for like 20 bucks

I use them. I love telling friends I use that because it sounds like such a scam site

Yeah idk why anyone thought that name was a good idea for their marketing

“just put your social here…”

I’m no statistics major, but that’s like 100% of the sample!!!

Competition does NOT make prices go up, lol.

Well, the point was that it isn’t competition in his scenario. I hope the exclusion of 1099 is temporary, because I had a 1099 for like a few dollars because I had a savings account that technically accrued interest, so as it stands that makes me ineligible. So his concern would be that because the tax prep services are competing against ‘free’ for that tier, that they’ll ramp up prices for the rest to compensate for loss of income.

deleted by creator

Given that savings accounts are at 1% interest or so, that’s only a thousand dollars in a savings account.

Good savings accounts are above 4% these days. Wealthfront is 5%, Synchrony is 4.75%, Marcus (Goldman Sachs) is 4.4%, Amex, Discover, Capital One, Ally, are 4.25%

Hypothetical question: If you omitted the couple bucks of income from the 1099 on that one savings account and you later got audited- how much money would you be on the hook for? what would the consequences be in worst case and likely case scenarios?

I honestly think the government has next to no resources now to go after tax cheats that aren’t hiding tens to hundreds of thousands of owed taxes… but would love to hear what others have to say. I suspect missing out on less than a dollar of taxes from omitting a single figure 1099 would not be big enough to chase and if found probably less costly than hiring a preparer every year when averaged out over your lifetime of tax returns.

Perhaps practically speaking you probably would get an automated form from IRS demanding a few dollars. But it’d be nice if qualification for ‘direct file’ option didn’t rely on “mild tax evasion” for people with savings accounts.

I would suggest you get hired by the IRS and start rewriting all their ancient code to build in and allow every deduction rule and that it’s applied correctly every time so everyone can use it.

The tax laws are so large and so complex and the code running all this stuff is so old and now locked in because they didn’t keep up with updating their software as they went along. I’m amazed they got this far. Oh, and like you, I can’t use it either. But that’s why I have an accountant.

I read

1099? Nope depreciation. Nope tax credits? Nope

why isn’t this constitutionally protected.

Can we pass an amendment for this shit? It’s actually kind of fucked up.

Kind of? Are you going to tell us that the US healthcare system is “sorta silly” next?

Sorta silly?! It’s fucked beyond belief. Source: me, someone who profits off the healthcare industry as a corpo. Sorry 🤷.

god if i had the arcane knowledge of the entire field of healthcare, i would do some unbelievably fucked up shit.

And by that i mean writing open documentation that is continually maintained and represents most healthcare providers in the US specifically to fuck up their entire existence.

Doo iiiiit! (If you can).

Honestly I do the best I can to fudge numbers and drive down prices, but I can only do so much. They’re eventually going to catch on and replace me with someone who doesn’t give a fuck.

lol, perhaps one of these days i will have enough expendable income and time to dedicate to this kind of shit.

It’d make for a rather fun experience.

From a certain point of view? Yes.

i mean, it is sorta silly. Not full sillyness, full sillyness would be forcing people in immediate life threatening injury to recite the ABC’s backwards before operation as protocol.

Sure, there’s degrees of silly

i spose there would be, but at the end of the day. Silly is a rather silly word to be using in this manner.

I think that some companies like turbotax are employing lobbyists to make impossible filing for taxes unless you go through a gatekeeper

yep, which is why its weird that we don’t have a legally protected avenue of direct filing.

I have a couple of other constitutional amendments I’d like to advance before this.

idk man i think i disagree honestly.

Tax is one of the very few constants that we all have to legally deal with, aside from like, auto insurance.

Wait really? What’s the catch?

Doubt there is one. The hard truth is that most Americans’ taxes are pretty simple and straightforward. We can stop pretending that copying some boxes from a W2 and a 1099 is difficult.

I mean, personally I wish we’d stop pretending that the IRS isn’t already fully aware of what you owe and could just do the filling for you, like in other countries, but until Grover Norquist fucks off forever we’re stuck where we are.

Right. Filing taxes should only be necessary if you have itemized writeoffs or wish to contest the IRS’s statement of your tax liability. They already know what you earned their your employer, what’s been paid in taxes, what basic credits your qualify for, etc. They know what you owe so long as you didn’t have expenses to apply for that they couldn’t assume or know about. The only reason they don’t already do that or, at least until now, have a free public system for filing, it’s because tax companies have lobbied for decades to be able to milk the public for cash to help them file and navigate their tax liability.

The argument has been since free filing means only the wealthy will hire accountants, free filing would discriminate against the poor given a few mistakes will be made here and there.

I may not need to mention that disingenuous argument is made by the pirates at Intuit and their lobbyists.

free filing would discriminate against the poor

As opposed to the current system where the richest among us can hire a whole team of accountants to find every deduction possible?

Shhhh!!!

It should also be noted that if the vast majority of people do nothing special on their taxes and just accept the government’s assessment, then that leaves a much smaller group of people to be audited. And a much larger portion of those people will be those who are trying to weasel their way out of paying their share. Right now, with the IRS being criminally underfunded, they only focus on low hanging fruit, the small fries. With those people being boiler plater auto-accepting tax payers, that would mean the IRS has no reason to audit them and can focus on the big boys where the real cheats are. That’s another big reason we do not have that sort of system and why the IRS is currently so underfunded (despite every dollar spent on the IRS generating between 5 and 9 dollars in revenue from tax fraud/evasion). Those kinds of people pay to make sure it doesn’t happen.

Ew

Holy Christ someone using disingenuous appropriately, I’d almost given up on the word. Thanks for saving it!

How exactly is it usually misused? Its use here matches every other time I’ve seen it as far as I can tell

I always see it being used in place or dishonest for people who think they are the same and feel it makes them sound more intelligent.

I can tell you’re being ingenuous and I believe you

Oh didn’t know it was misused!

🍻

They know what you owe so long as you didn’t have expenses to apply for that they couldn’t assume or know about

Solo 401ks/IRA also wouldn’t be something they know about until you file if I understand correctly. Guess you could that expenses?

They should (and do?) have the same information your employer, bank, or brokerage files. i.e. the same forms you use to fill out your taxes now. They know what you contributed to you 401k and your other retirement accounts.

Solo 401ks are where you’re the employer (guess technically there’s some wiggle room for others to be in your 401k, but from the perspective of such a person, wouldn’t it just be a normal 401k?). So you have to report it yourself. The brokerage firm holding it won’t.

Well, yeah. If you’re self employed, you have to report yourself too.

They would go in the sections for 401ks and IRAs just like they do on the paper forms. The online form will have the same way to enter the additional deductions.

I understand why we do out taxes in the current situation, kinda. If the irs just sent you a bill it would be ripe for people thinking they were getting ripped off. People hating taxes and thinking they’re getting robbed is about as American as it gets. The whole boston tea party thing. People on both side doing the math holds people accountable. Also the current tax bracket situation kinda needs some end of the year math. Now, if it was a flat tax, a fixed percent… THAT EVERYONE pays no matter how much you make then it would be easy math. But they gotta make sure the middle class is paying 22% of their income to the feds and the billionaires pay one tenth of a percent… you know… for reasons. Then there are a billion write-offs and loopholes the rich can exploit, so they gotta keep those there.

If it was, say, 5% for everyone, no matter what you make, then it could easily just come out of your check as you get paid with no bs at the end of the year.

A flat tax is a poor tax. 5% of your income means WAAAAY more to someone working minimum wage with two kids than someone who has a second home, even if dollars and cents it’s way less. And the wealthy will evade a flat tax as much as they already do a progressive tax.

Now, if it was a flat tax, a fixed percent…But they gotta make sure the middle class is paying 22% of their income to the feds and the billionaires pay one tenth of a percent… you know… for reasons.

I fall into the lower end of the middle class (nationally) and my income tax is about 11%, but on top of that, after deductions and credits I end up deducting myself into the lowest tax bracket and collecting credits so I get a nice chunk back every year. To actually pay a full 22% of your income in income taxes, you must be making pretty good bank (and probably spending pretty good bank if you’re still considering yourself middle class)

Flat taxes are extremely regressive. The whole idea of tax brackets is that those with more ability to pay pay more and those with less ability to pay pay less. If you only make 22k/year you need all of that and that $2200 can be pretty lifechanging, but if you make 220k per year you can live without that $22k. There’s also fun stuff with how much tax revenue the government can actually bring in depending on who they tax harder, and generally it favors taxing the rich at a much higher percentage rate than they do the poor.

I’ve been in the US for a few years now. All my colleagues told me that doing taxes is hard. So I used to reluctantly pay money to do it through Sprintax. This year, I decided to do it by hand. It took almost the same amount of time as it would’ve taken to do it through Sprintax, which is around 30 minutes.

Even with multiple savings accounts, IRA/401ks, an investment account, and two W2s; it’s still relatively straightforward. You just need to grab the forms, as they are legally supposed to be provided to you.

In italy the data is pre-filled, you just have to check if there’s something missing and you’re good to go, but you still have to send the module manually, like going into the website and doing the stuff.

It should be all automatic, wtf

Don’t they just assume that everything is good if you don’t reply? Works that way here

It’s not a “reply”, it’s a thing that you have to do, so that if you owe the government something you’d pay it, elsa you’ll receive money if the government owes you something (for example, a percentage of medical expenses gets “refunded”)

Here if you owe something you’ll get basically billed for it and if you are owed they just inform you about it and pay it to your account. If you are owed or you’re even then you don’t have to do a thing. No confirmation, nothing to do, you can ignore the whole thing. Is it the same for you guys?

Unfortunaly not 😂

Grover Norquist fucks off forever

This is the world I want to live in.

most Americans’ taxes are pretty simple and straightforward

Once the reporting for income over $600 from shit like eBay sales, Venmo, etc kicks in, the 1099 they issue would make free filing ineligible

step one for me is get out last year’s so i have a point of reference. just do the same thing again. numbers are a bit different, but the general ‘what-goes-where’ is usually the same–unless they split a form into multiple pages, or add an extra page to one.

once i get the new blank forms printed, it’s about 15 minutes for me to fill-out, copy, and stuff inside an envelope. this year’s added yet another sheet, i had to use a flat instead of the usual #10. cost more to mail, too, but i will not ever ‘e-file’.

one of the few perks of being poor—easy taxes.

Removed by mod

You’re acting like the filing that would come from the government would be the final record and you wouldn’t be allowed to correct it, which is not at all what people are suggesting.

Plus, audits will still be a thing.

y u no be nice about it :(

All of those things you mentioned are edge cases which you would still be able to handle yourself if they auto filled everything for you.

I use an online tax service which scans my w2 and filles it out. It still gives me the option to edit stuff but I mostly just check to make sure things look good.

How would they know now? It’s the same answer. Stop being a dick.

Unless it’s changed from the pilot, it’s only useful if you file a 1040EZ or take some really basic deductions. Anything beyond the basics, like any kind of investments, means you need to use a different tool.

But freetaxusa is still free for all but the most complex cases.

From the article:

The pilot program targeted people with simple tax returns based on W-2 forms. In her remarks today Yellen said that over the next few years they will expand Direct File to support more situations.

But even that would cover a large percentage of the American workforce, and I imagine over a few years, it will grow to cover all users that don’t need personal accountants. Progress is progress.

Personally, I hope this transitions into a system where they email you a proposed return and you do nothing to accept it (only needing to take action if there’s an issue).

I’d say it’s still a win, and I’m hoping they expand upon it.

I expect that you’ll have to pay the money according to the statement

The catch is that Turbo Tax and H&R Block are gonna lose a ton of revenue

You have to register an account with the 3rd party service ID.me that uses biometrics like facial recognition. Their privacy policy is horrendous.

The only reason I haven’t used it this year.

Only catch is Republicans probably launching some type of legal action to try and stop it.

No lawsuit launched yet to my knowledge, just sternly worded letters saying please stop helping taxpayers instead of letting predatory companies like Intuit fleece money off of them.

I would expect them to try something soon though with this announced.

I was in a pilot state (Arizona), and I looked into it. It’s only for federal taxes. You need to file state taxes separately.

There are already several online tax solutions that offer free federal and charge for state.

Does Arizona not have an online free system? Illinois has a very hand-holding guided set of questions and has for years, it’s always been our federal taxes that make my head hurt to fill out via the IRS’s FreeFillableForms site.

It probably doesn’t do state taxes.

You get to pick which oligarch or corporation gets your tax money this year!

Welcome to 2005, America!

Huh, I went to check - we did it in 2003 (for vat and income tax iirc, ofc they expended it since, nowdays only courtroom stuff doesn’t have online admin systems).

Prior to that you just got the (already filled out) income tax form in the mail - if everything was ok that was usually it. In case you still owed, it included the bill, it they owed you they wired the money to your bank.

If the tax forms were incomplete for some reason (or just not optimised between the members of the same family) you could fill in what they missed (like literally with a pen) & send it back (for them to verify & return it to youb revised).

(This system still works so folk who prefer to do it via paper can do that.)

Hold my beer…American pulling out checkbook

The catch is that it requires ID.me, and there is no way in hell I’m giving some third party a picture of my fucking drivers license.

I hope more scrutiny is given to ID.me. I’ll only be using Direct File if they remove it as a dependency.

Seems odd. They’ve been pushing login.gov like everywhere.

It will eventually be supported, and in the interim they have stated that they won’t keep biometric data obtained through ID.me once a verification is completed, or you can opt for an online interview where no biometrics are collected in the first place.

Who knows if ID.me will actually delete the data on their end though, or if the online interview is recorded by the provider.

Government biometric requirements really aren’t a joke. They perform pretty regular audits and the liability of not deleting ID could be company ending.

They might not delete your biometrics, but I’d be shocked if they didn’t. It’s far more likely that they not only delete it but have an audit trail proving deletion.

I even had to make a login.gov account to apply to some federal jobs (ironically enough one was with the IRS even!)

On a related note, it appears based on their job listings that the IRS will not hire anyone who owes them money

Interesting that third parties like TurboTax aren’t required to obtain copies of your photo ID.

I looked it up, and there is an article from the end of last year that says they are about to be required or are already required.

I can’t recall ever putting my license on one of these tax preppers, but I am also older and more privacy concerned in my older age, so I would definitely not do it now.

At that point, might be better to hand-file your return. In many of these programs they offer you the ability to print and mail your return.

Your refund takes longer of course.

Eh, I’ve only gotten like $20 back max the last three years. They can take as long as they want, I will not be giving any third parties anything that they truly do not need.

…to print my ID in the first place?

(But yes clearly worse to allow personal data to be stored in an additional system.)

Right, my government also gave me a number at my birth. They know where I live, they know how much I make and where I work. The third party, ID.me, definitely does NOT need any of my information, since the entity that is taxing me, already does.

Depressing thought: there’s a remote possibility the government is inept enough trying to roll around verification system that a third party has a safer solution.

Positive thinking: maybe the government is just using a third party until they’ve had time to make their own service entirely bombproof. Let’s go with that for our sake.

And then ID.me becomes the new TurboTax and starts lobbying the government to not compete with them.

Noooooooooooo

The problem is that given all of the data breaches, anyone can use your social security number, address, etc. and file a return on your behalf.

In theory, that’s what ID.me is preventing.

But if your wallet gets stolen, good luck.

Huh, I already signed up for it because they started requiring it a while back to access historical tax return documents through the IRS website.

Why, do they sell data?

It would not surprise me in the least, but more importantly, if they get breached and they have sloppy mechanisms in place, my license could be fully out there in the wild. May be whatever to some, but I think it’s too risky to trust some company with it that also has contracts with the government itself.

Wouldn’t they need to already have your data to check your driver’s license against it?

I had to use that for my unemployment insurance claims.

Mine was too complicated to file for free because I have retirement investments? Seems like a silly reason to force someone to use a paid service.

You’re not supposed to be wrecking our economy like that. Spend, baby, spend.

😂😂

Sounds like having any 1099 is ‘too complicated’. So anyone with any sort of savings account that managed to get $10 of interest over a year… So if you have like a thousand dollars in a boring old savings account you are ‘too complicated’.

Yep, kinda surprised me to be honest.

Not really. If you are filling out $10 1099s you’re probably taking a standard deduction so it never matters.

Wow, old comment.

1099 is income, not a deduction.

That’s a good point.

Yeah. Mine was “too complicated” because I had an HSA. Are you fucking kidding me?

Feels like a ruse

Same. It sucks having to pay H&R Block $300/year to file my taxes, but their online records save my ass every time I buy a house. I sincerely hope we see a more robust free file system in my lifetime.

$300? Just use Free Tax USA. It’s free for federal and $15 for each state. No, you don’t need extra stuff, unless you think you’ll be audited.

If you spend a little time figuring out your tax situation, you don’t need to pay someone else to do it. Here’s a secret: the people they have doing your taxes don’t necessarily have a master’s degree in tax. Those people are helping corporations or wealthy people with trusts.

You missed the point of my reply. I pointed out that the benefit of H&R block is that they keep the records easily accessible, so when I buy a home I just link the H&R block account to the lender and they pull all of my tax and income history. Saves countless hours of gathering info and filling out paperwork. That’s worth $300/year to me.

You wanna pay and extra ~$280 a year because you save a little bit of time when you buy a house? You know FreeTaxUSA has all your documents too, right?

You’ve never bought a house if you think it’s saving “a little bit” of time. We’re talking easily 40 hours of gathering and filing paperwork here. That’s $2,200 of my time. If I buy a house once every 7 years it works out.

I’ve bought two houses and it did not take me 40 hours of gathering paperwork. Maybe an hour or so maximum to get my paperwork for the bank.

Do you buy houses all the time? Do you want your income info to be sold to anyone who will pay? You are paying extra for them to have access to your info.

I buy a house on average once every 3 years and it saves me apx $2,200 worth of time.

Thank fuck. Finally

deleted by creator

No, we have 50 states to get through as well. And then all the municipalities.

God, it’s times like this where I wish we merge some states.

Sorry, but still very far behind on this and many other things.

Biden did that, among many other great things for the average american citizen

Even without access to Direct File since I wasn’t in a pilot state, I’ve been using the IRS’ “Free Fillable Forms” for the last few years and they’ve worked great! They don’t hold your hand as much as the paid software but for my returns they’ve been more than adequate and free!

Does anyone know how “Direct File” differs from the “Free Fillable Forms”? Does it hold your hand a little more and help you find credits/deductions? Free Fillable Forms worked well, but only so long as I knew what I needed to file. New circumstances, like adding a dependent, lead to a lot of research.

Yes, direct file is guided with a checklist. However there are only certain situations where a taxpayer would qualify for direct file - there’s income limitations and only certain income types qualify (u would not be able to use it if u are self-employed or own rental properties for example). The IRS is planning to expand this but for now it’s limited tho the vast majority of taxpayers would qualify.

Anyone can use the free fillable forms but u either have to know what you’re doing or be comfortable reading irs form instructions if you have a more complex tax situation.

Good. Now make it work for everyone’s tax situation.

You need to enable JavaScript to use Direct File.

On the plus side, UBO only had to block one script (on the login page at least).

how much longer til they just do it for me and leave me the fuck alone?

🤞

He gets it

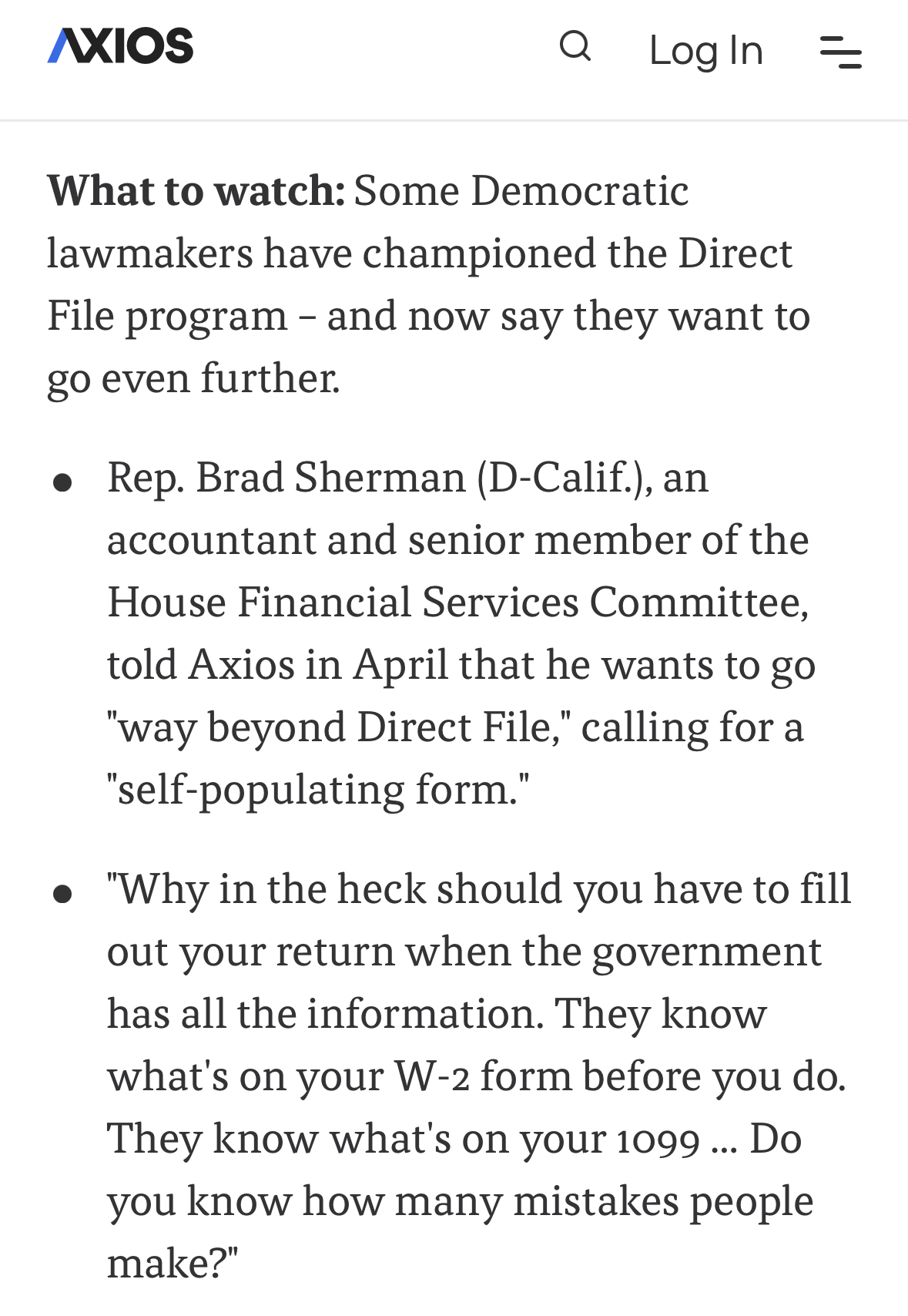

Dude’s face alone has accounting credentials: https://www.congress.gov/member/brad-sherman/S000344

I’ll take that over celebrities as politicians any day