North Dakota voters will decide this fall whether to eliminate property taxes in what would be a first for a state and a major change that officials initially estimate would require more than $1 billion every year in replacement revenue.

Secretary of State Michael Howe’s office said Friday that backers submitted more than enough signatures to qualify the constitutional initiative for the November general election. Voters rejected a similar measure in 2012.

Property taxes are the base funding for numerous local government services, including sewers, water, roads, jails, deputies, school building construction and teacher salaries — “pretty much the most basic of government,” said North Dakota Association of Counties Executive Director Aaron Birst.

deleted by creator

That’ll show them socialist fascist commie lefty groomers.

deleted by creator

Oh this is curious! Cause the solution would be for those services to be privatized. I wonder how many would pay for those services.

“No, Jimmy. You don’t need to go to skool. Now go change bale the hay.”

deleted by creator

What do you mean putting out the fire in my house costs me $25k?

Traditionally, privatized services like that just took the house.

State created a sales tax to replace it.

“Why are my groceries so expensive!!!”

What do you mean we have no police,fire,schools,water,roads?

Somehow there’s always money in the banana stand for more cops.

Look what happend to kansas after they cut taxes like that. Libertarianism fails faster than communist countries every time.

Is it they got a two term Democratic governor and asserted to not amend the Kansas constitution to specifically state abortion wasn’t included?

There definitely are better taxes than property taxes. But, since it’s a red state, they would probably replace it with a worse one. Or just debt.

It’ll probably be replaced with sales tax increases. Sales taxes are very well-known to be regressive.

Or think of “low-tax” Texas, where every other road is privately operated and charges tolls out the ass.

Even ignoring privatized services, taxes in Texas are higher than California for the average person. It’s a total myth unless you belong to the upper class.

Hence why “low tax” is between quotation marks

“Every other road…” serious [citation needed] there. I live in San Antonio (you know 6th, largest city, metro of 2.2m people) and there’s not a single toll road. Austin, Dallas and Houston have a few but it’s by far not every other road. You can get around on 10, 35, 45 and the corresponding ring roads just fine.

Also the property taxes here are quite high compared to a lot of other states, but as such there’s no state income tax.

I live in Austin and they’ve built a toll road bypass to the interstate, added toll lanes to loop 1, and now they’re adding them to 183.

Lt. Gov Dan Patrick is on a crusade to end property taxes and replace them with…🤷♀️

charges tolls out the ass.

User fees are so variable. We have a commuter rail system that is financially destitute because it was user-fee based and then #covid. Now it’s in mortal disrepair - I know what I said - and trying to reduce services but keep prices high - shrinkflation - to remain financially viable.

Rail competes with flights and driving for business. People are choosing not to take trains because it’s worse than flying or driving. If you build it to the point where it’s better than flying or driving, people will use it. Americans have no aversion to trains, they have aversions to bad service. See the Brightline projects and the Acela Express. High-speed, high-quality rail can work and be profitable in America.

Road tolls in Texas compete with being unemployed. People have no choice but to drive and pay because of Texas’s horrendous urban design.

Sales tax benefits residents more in states with high tourism like CA, FL, NY. But ND? Lol

This would be great if it eliminated property tax for primary residences or something like that. Everything else is a handout to the wealthy.

Big A Libertarian Walks into a Bear energy.

Fun fact. That was in Grafton, NH. NH doesn’t have sales tax. Instead, there’s a correspondingly high property tax.

At least they get good value for it. The schools aren’t terrible, and the roads are better than the much wealthier state of MA right nearby.

Does North Dakota have the same tourism industry that New Hampshire has?

deleted by creator

Definitely not. There’s Teddy Roosevelt National Park, which is gorgeous, but it doesn’t attract nearly as much tourism of all the stuff that’s four hours south…

South Dakota has Badlands National Park, Mount Rushmore, Crazy Horse, Wind Cave National Park, Jewel Cave National Monument, Minuteman Missile National Historic Site, Mammoth Site, Black Hills National Forest, Deadwood and Sturgis, a couple good private zoos in Reptile Gardens and Bear Country. All of that stuff is within a 1 hour drive of Rapid City, which has plenty of good hotels and restaurants and just generally what you’d expect from a modern midsize city. Rapid City is honestly worth the trip for anyone, but If you’re a real outdoorsy person then you could easily enjoy a month out there. Oh and then not that far away (relatively speaking - 2 hours drive) is Devil’s Tower in Wyoming.

So no… NoDak is comparatively sparse. And they probably like it that way.

Gonna get even more sparse when they eliminate running water and sewage service.

NoDak is comparatively sparse. And they probably like it that way.

And therein lies the problem. New Hampshire gets away with it because they have money coming in from people visiting the state (and the state owning the liquor stores).

And they get some “bedroom community” money from people working in and around Boston that don’t want to live in Mass. Not an unreasonable commute down i93 or i95, especially if your job is in the north burbs.

Pretty sure none of that applies in North Dakota. Maybe there’s folks working in Fargo or Grand Forks that prefer Minnesota? But it’s not many.

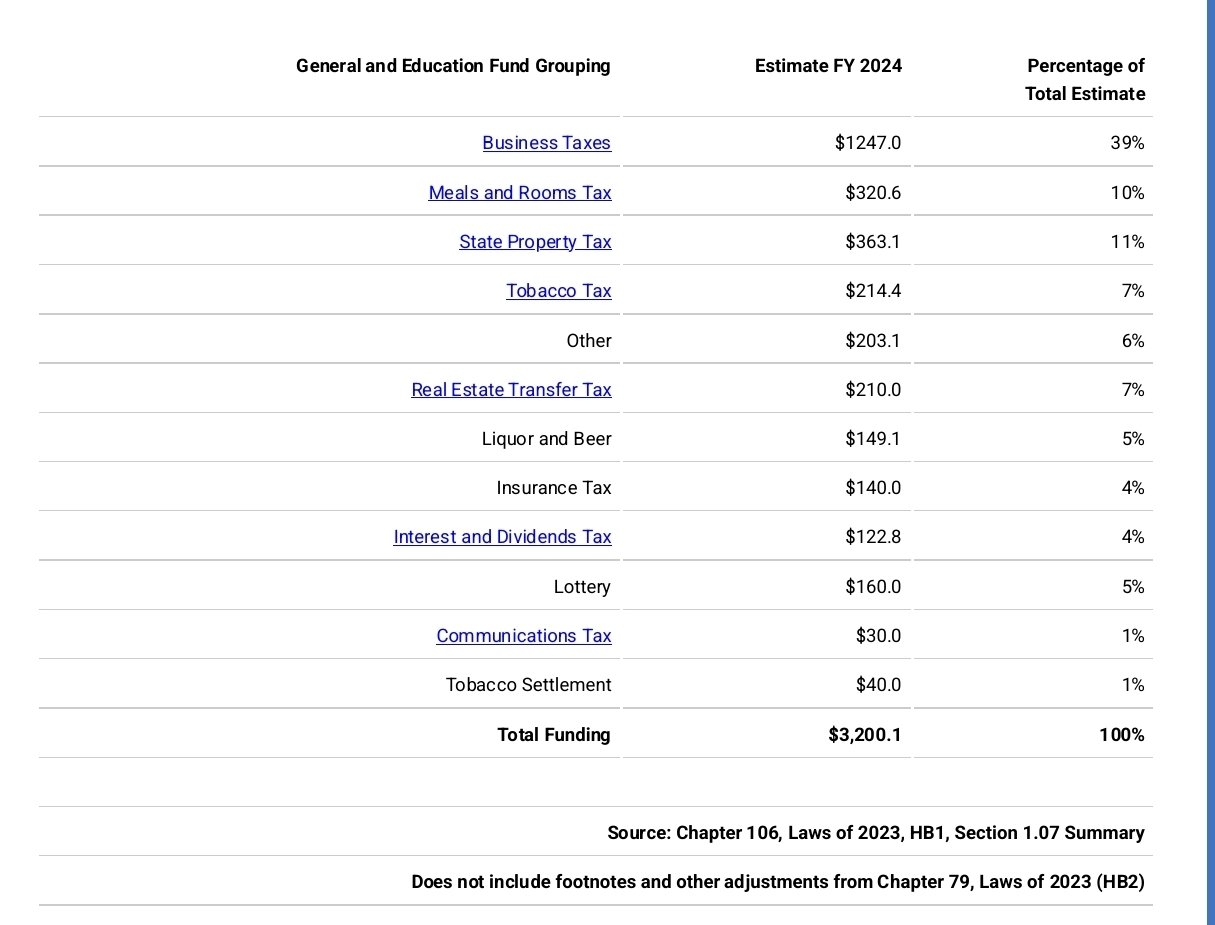

For anyone interested

For anyone wondering why “Liquor and Beer” doesn’t say tax at the end like tobacco, every liquor store in the state is run by the state.

https://www.nh.gov/transparentnh/where-the-money-comes-from/

Another red welfare state making it worse

I’m pretty sure that this isn’t a Democrat-Republican issue.

goes looking

Yeah.

Nebraska and Texas have some of the highest effective property tax rates in the country.

Hawaii has one of the lowest, and California’s pretty low too.

There’s definitely regionality – the Midwest has (mostly) high, and the western Great Plains states low – but it doesn’t really map to Democrat-Republican status.

north dakota’s tax burden overall is pretty low, though: 7th lowest among the states.

But you have to compare it in context.

In Canada, Alberta has no sales tax because they make so much money from oil. In normal conditions and with a working government that is not idiotic, such a system could work. However they have a stupid government that only does this to buy votes so when oil drops they drown

So, in this context, does North Dakota have an alternative revenue stream to compensate?

they have a stupid government that only does this to buy votes so when oil drops they drown

Remember, Peter Lougheed first won the region for the conservatives on a platform of fiscal resilience through diversification and using oil money specifically to fund the development and growth of people and sectors currently ignored. The ignored people liked this.

Then the party, after winning, gutted the plans.

So, it’s not like this is their plan. It’s their plan, despite alternative plans winning in the polls to get them the region, which were then gutted in favour of their plan. Said another way, they could have been better, the voters wanted better, they didn’t get better, the voters didn’t bury them for it. They’re the “stop hitting yourself” of voters.

Exactly right

Yeah. Oil.

It’s the third highest oil producing state in the country and like seven people live there.

And is the oil industry paying their share so the government of North Dakota can continue their duties without property taxes?

This is a terrible idea, property taxes are better than pretty much all of the alternatives

deleted by creator

The short answer is economic efficiency - when we tax land we’re not discouraging useful behavior. Any other tax also reduces your income and in doing so undermines your ability to meet your basic needs while also adding more friction into the economic system that you use to do so.

How are they a better tax?

- consolidation

- reverse monopoly

- not user-fee-based, and thus a steady and uniformly dependable source of income

- can’t deke out of it

It’s math, Skippy.

deleted by creator

They’re replacing it with Land Value Tax, right? Right?..

Or sales tax, or something else. High taxation and misuse of taxes is bad, but taxes themselves support the infrastructure everyone uses. So if they get rid of this, something else is going to have to take its place unless the property tax was way too high.

I thought we’ve seen what happens when you don’t have blended tax sources.

But surely, this time, it will work?!

Direct wealth seizure

That is a terrible idea if you want a functioning government.

That is a great idea if you want government to fail.

The roads will take 10 years to turn into alabama, but they will.

Nope, North Dakota has snow and ice, so it won’t even take 5.

deleted by creator

Property taxes are the base funding for numerous local government services, including sewers, water, roads, jails, deputies, school building construction and teacher salaries — “pretty much the most basic of government,” said North Dakota Association of Counties Executive Director Aaron Birst.

I guess if that’s really what they want to defund, then go for it, but don’t expect any federal dollars.

Whatever they will come up with will be regressive and mostly affect poor people.

Once the most socialist states in the country…how far we have fallen. It is a politically sad place now.

Huh, didn’t know that they still have a state run bank up there.

https://news.prairiepublic.org/show/dakota-datebook-archive/2022-05-22/socialism-in-north-dakota

It is a politically

sadbad place now

I went through the middle and western part of the state last year, and almost everyone we met was angry af and weirdly entitled. Having been in Minnesota the week before, it was like night and day.

I think everyone is ok with property taxes. What homeowners hate is increasing property tax. It should be a flat rate for everyone that doesn’t increase with the exception being on non residential properties.

Ok, I’ll bite.

How is a state meant to keep up with inflation if property taxes don’t increase to compensate?

And do you mean to say that property taxes on a mansion situated on several acres should incur the same flat rate as a 1000 square foot home on a quarter acre?

The increase should be capped at inflation. Currently mine go up 10% every year. I pay more in tax than I ever paid in rent. I’ll have to buy a tent in another decade at this rate.

And where are you?

Associated Press - News Source Context (Click to view Full Report)

Information for Associated Press:

MBFC: Left-Center - Credibility: High - Factual Reporting: High - United States of America

Wikipedia about this sourceCalling the Associated Press “left” is just a blatant admittance that the right’s ideas are not based on facts and reality. This bot is trash propaganda and I call on mods everywhere to ban it.

Blocked that dumbass bot. It’s truly awful.