cross-posted from: https://lemmy.zip/post/50962591

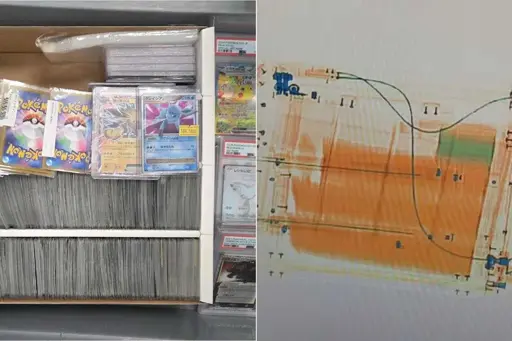

The Singapore Customs is investigating a case where a man entering Singapore did not declare that he was in possession of assorted Pokemon trading cards worth more than $30,000 in total.

Not that he’s not reselling them, but paying a 9% tax for every single item you posses beyond $500 in value every time you cross the border is just absurd. Remind me to never take my laptop, phone, or a decent camera anywhere near Singapore.

All that aside, I thought the idea of customs and import duties was versus new items, not things that can be picked-up at a second-hand store or pawn shop. If he provided itemized receipts, would they even believe him if the prices weren’t high-enough? … or were “too old”?

I got a couple kidneys that are gonna ding me here.

Seriously, though, people regularly travel with luggage and watches and shoes worth more than $500. How are Pokemon cards any different?

paying a 9% tax for every single item you posses beyond $500 in value every time you cross the border is just absurd.

It would be if that were the case. What makes you think it is?

Probably the wording in the article that seems to say exactly that?

The Singapore Government’s Factually website states that all goods brought into Singapore are subject to goods and services tax, currently pegged at 9 per cent. However, travellers are granted GST import relief based on the duration of their trip.

Those who have been overseas for 48 hours or more are entitled to GST relief of up to $500. For trips under 48 hours, the value is capped at $100. The GST rate is currently pegged at 9 per cent.

These amounts apply to the total value of goods bought overseas, excluding liquor and tobacco. Any value above the relief limit is taxable, and travellers are required to declare it upon or prior to arrival.

Singapore work permit, employment pass, student pass, dependent pass or long-term pass holders, as well as crew, are not entitled to GST import relief.

The term goods isn’t specified, but could easily be interpreted to mean absolutely anything they want potentially.

These amounts apply to the total value of goods bought overseas, excluding liquor and tobacco. Any value above the relief limit is taxable, and travellers are required to declare it upon or prior to arrival.

Doesn’t apply to everything you possess and traveled to and from with, only that which you’ve bought overseas and brought home

That seems fairly standard with most countries having something similar. From the SG govt website,

If you are a bona fide traveller (excluding holders of work permits, employment passes, student passes, dependent passes or long-term passes), you will be given GST relief on new articles, souvenirs, gifts and food preparations that you bring into Singapore which are for your personal use. The relief does not apply to intoxicating liquor and tobacco, as well as goods imported for commercial purposes.

I’m guessing this guy fell afoul of the ‘commercial purposes’ clause.

The word “new” makes this a very different rule.

I see what you’re saying, but this is one of those things that the news article author (not the law) probably didn’t notice because it just seems like such common knowledge. Used items are considered personal use items and would never be considered for taxing, only new items would be taxable.

Unless, of course, you’re carrying 30k worth of pokemon cards.

It’s also interesting that the set of cards is considered a single item, unless again the rules as cited are still too arbitrarily worded.

The govt site does not say anything about single items, only the generic term ‘goods’ is used

I read the article.

Article could be better written. The govt site is clear it’s about new items.

Thus the confusion in my first comment. Governments play at least as fast and loose with their own rules as this dude did, and you’re right, its stupid the article doesn’t mention it at all.

Meanwhile billionaires dont pay shit.

assorted Pokemon trading cards worth more than $30,000 in total

That’s like, a single shiny Charizard according according to some kid I went to elementary school with like 3 decades ago…

Holy shit, $30,000 three decades ago is worth $63,774.80 today. Hope that kid held onto it. He’d be set for life.

That value is aftermarket resale. The cost of the cards is about 3.50, this seems bullshit, unless they guy had them insured.

Interesting. Apparently their status changed from collectibles to priceless antiques.