Key Points

- As shoppers await price cuts, retailers like Home Depot say their prices have stabilized and some national consumer brands have paused price increases or announced more modest ones.

- Yet some industry watchers predict deflation for food at home later this year.

- Falling prices could bring new challenges for retailers, such as pressure to drive more volume or look for ways to cover fixed costs, such as higher employee wages.

When’s the last time the US saw significant deflation? The 30’s? Can’t say I blame them for their fear. But they’ll see no sympathy from me! We’ve seen two whole generations born, raised, and passing away in the age of “Number always go up!” business. At least the greatest generation grew up hearing stories of difficult times when it was the unions and collectives that brought them through the darkness. I’m sure current business leadership has no clue how to face this. It’s passed out of living memory.

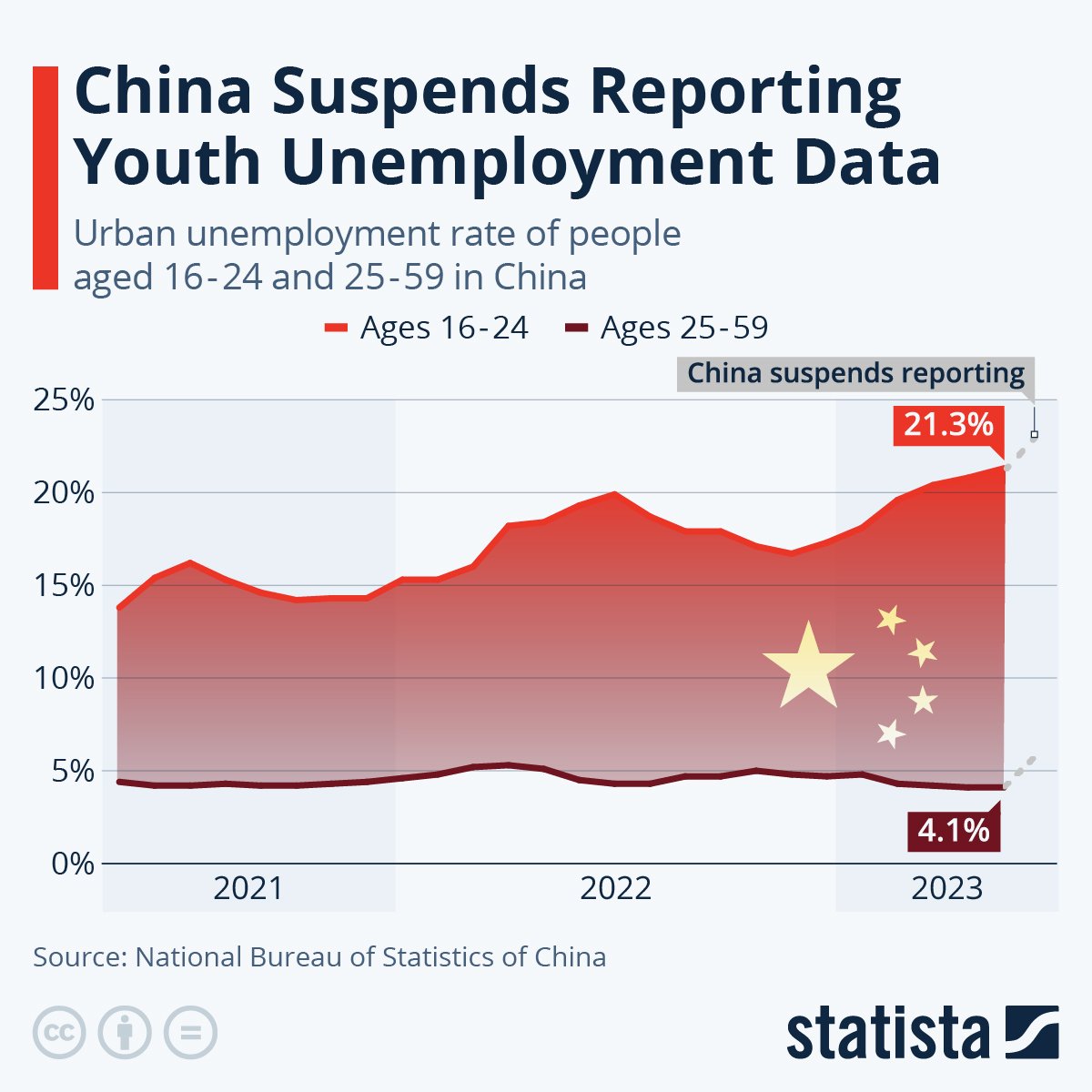

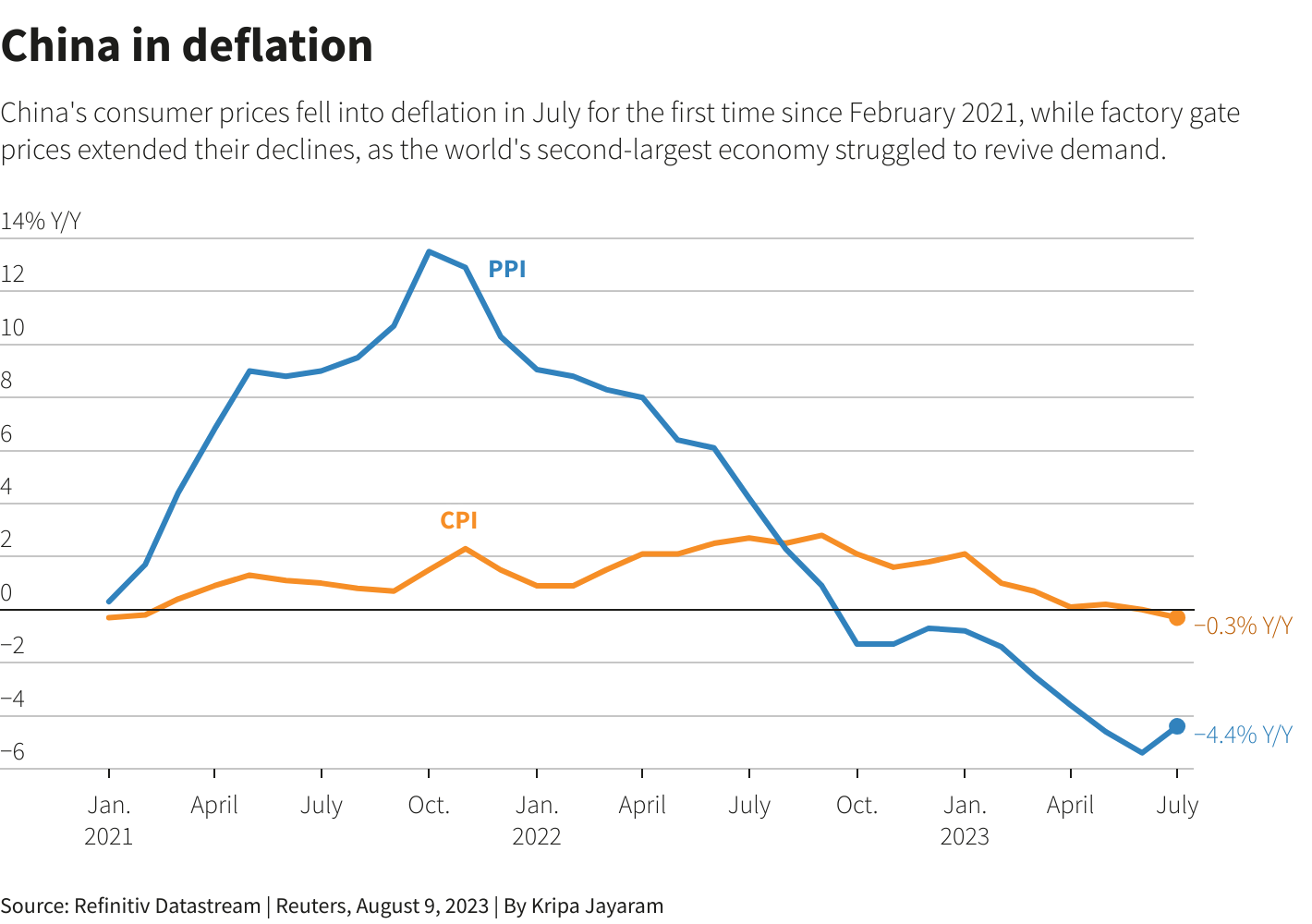

You can see the massive deflation happening in China right now as youth unemployment hits 25%.

No thanks. We don’t want that over here. Inflation is (and always will be) better than mass unemployment. If you want lower prices, open up our trade with others (IE: Import China’s goods since they’re suffering from deflation: we can benefit from those lower prices).

No thank you, we do not need China dumping their goods in our markets. Just look at the EV dumping going on in the EU.

Decoupling is why you see massive deflation and unemployment in China and part of the reason why you don’t see it in the USA. Opening our markets to them would doom many of our industries and drive up unemployment for our youth.

I thought the US loved free trade? Oh, only when it benefits the corporate masters, I see.

No, the US does not love free trade. The current global economic environment where anyone can trade anywhere was established during the twilight of WW2 during a meeting at Bretton Woods.

Historically Imperial powers would occupy the vanquished, dismantle their adversaries economic systems and make them vassal states. They would then close their systems to outside trade and reap the rewards.

There were two problems with that for the US, first it would take a large military to do this (and we did not want to field those armies long term), second it meant we would probably have to fight the Russians directly as they would want to become an imperial occupying force (which they did) and would probably try to compete with us (which they did).

Instead we decided to bribe the Europeans into fighting the Russians for us. Hence the current global order where anyone, can trade anywhere for anything. We backstopped freedom of the seas with our fleet. Opened our markets to trade and provide financial assistance to help rebuild Europe. In exchange the European powers subjected their foreign policy to us and agreed to fight the Russians.

Europe, Japan and the rest of the Western world embraced this new economic system and it became foundational to their economies. To the US this was just a security deal, yeah we opened our economy but we never fully invested our economy in it. Which is why you don’t see many regional free trade deals passed beyond NAFTA after the end of the Cold War. We prefer to negotiate bilaterally with individual nations. We rarely ever open our markets without major concessions from the other side. We are also becoming more and more insular and are slowly pulling away from the global order we created because for us it was always just a security pact and we really don’t need it in a post Russian/USSR world. There is no popular support for NATO or any of the other institutions we created. Trump is a brainless Russian meat puppet but he knows how to read a room and the US electorate aren’t enthusiastic about staying connected to the rest of the world and subsidizing the costs maintained the current order.

Question for the economists in this thread. Everyone seems to be saying that a lack of at least some inflation is bad but also that wages going up to meet it is bad. Isn’t this a system automatically doomed to fail? Eventually in such a setup no one can afford anything and the economy collapses.

Inflation is fine as long as wages rise with it.

The issue is our economy is entirely built around low interest rates and low inflation. It’s been that way for a generation. This benefit asset-holders like home owners and the wealthy. Hence why they are doing everything possible to avoid wage-growth. They don’t care about inflation, what they are terrified of is wage growth and higher interest rates.

If wages rise together with inflation you get hyper inflation.

No, that’s nonsense. Wages going up are not going to cause 1,000% inflation per year.

But it will and there’s plenty of precedent, like Weimar Republic.

That’s not how that works. That’s not at all how that works.

Right… Well, enlighten us all! Maybe you’ll get a prize or something for disproving economists!

No, that was because of high volumes of money printing to pay debts.

Yeah, debts to workers.

Retailers fear things that would help consumers consume? Sounds like retailers don’t know how to succeed without gouging.

The last time USA had extended deflation, the Great Depression happened. When people stop consuming, retailers fire their workers. Then fewer people can consume, so more people get fired. This goes on enough, then its not just stores who fire workers, but it trickles to factories, R&D, office workers, etc. etc. The longer deflation happens, the further it spreads and the more people lose their jobs.

Ever since the Great Depression happened, US Policy has been strongly anti-deflation. Our policy is to “err” on the side of slight inflation.

So what happens when retail workers don’t get paid enough to consume even with jobs?

Prices drop, causing more people to get fired. IE: The Great Depression. Or if you want a modern economy that’s undergoing this shift, just look at China right now.

If people can’t afford things, your only choice is to fire workers and drop prices further. That’s just economics. (Why do you need workers? No one is buying anything, so fire your workers. Duh). The more people realize that this is the only strategy to survive, the lower prices get, the more people get fired, and the less that people can consume. It gets worse and worse until economists change policy and pull you out of this.

This is why we have large pseudo-government central banks keeping watch over our economy. Deflation cannot be tolerated. Yes, inflation sucks, but at least people still have jobs and livelyhoods in times of inflation or hyperinflation even. That’s actually survivable. Deflation is NOT survivable, it sucks so much worse. Deflation is all-hands-on-deck we need to work together kind of situation. We never want to push the economy to that direction.

China isn’t doomed btw. China’s plan is to exports goods to Europe and hope that Europe buys enough Chinese crap that they can kickstart demand again. And as prices drop further and further, Chinese goods will get cheaper, and crap like Temu will pop up to sell these cheaper goods to everyone. Now there’s geopolitical repercussions to this (not everyone will want to support such “dumping” of goods into our countries), so there’s no guarantee that China will be successful on this front.